Modern Bankruptcy Intake

Bring your law office into the 21st century with efficient and elegant bankruptcy client intake services

Not having to hound my clients to get their pay stubs and bank statements is fantastic. Lexria significantly reduces the back and forth between my office and clients and allows my clients to focus on making sure they provide me with everything else I need. My clients can focus on completing their case questionnaire and not having to gather documents.

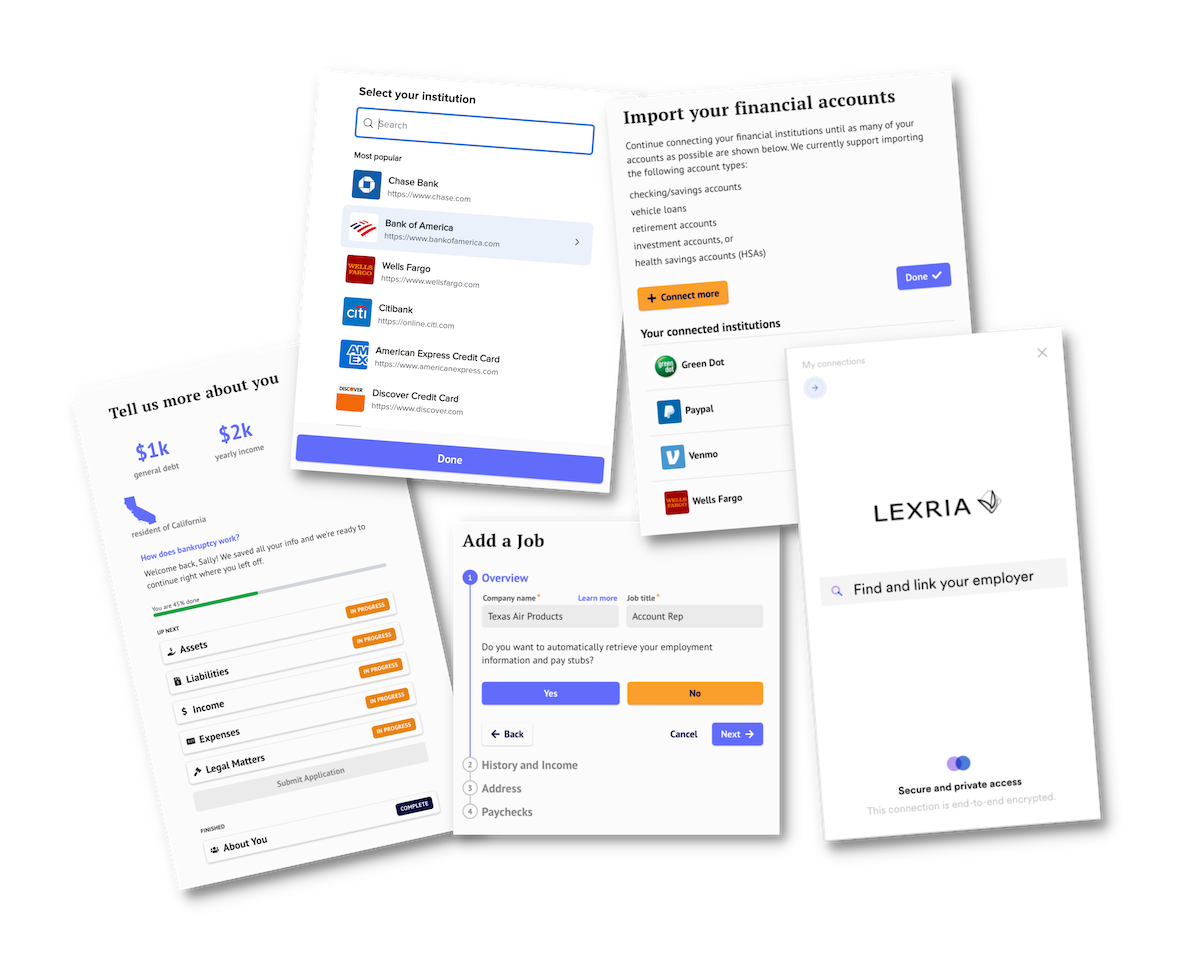

Streamline bankruptcy intake into one easy workflow for your clients

Lexria saves you and your clients time by automating and streamlining every possible piece of the intake (and we take that challenge seriously)

Lexria Intake

We’ve designed our intake with your clients’ peace of mind in mind: our human-centric design methodically captures client information being overwhelming.

Your attorney portal gives you access to see exactly where your clients are in the process, and to view the places where they might be stuck.

Lexria Pay Stub Service

Your clients connect directly with their payroll provider.

Automatic updates are included so your 6 months are always current.

Lexria Financial Account Service

Automatically pulls client financial data directly from their bank accounts, credit cards, Venmo, Green Dot, and more!

You receive a clean PDF per account.

Lexria has solved a significant problem for practitioners and clients alike by collecting and presenting information in an easily understood and well organized format. It saves me and my staff a significant amount of time, and makes the process much easier for my clients.